Step-by-Step Guide to Check Your Credit Score Online

A credit score check refers to the process of reviewing a person’s credit score—a three-digit number representing their creditworthiness. This score is calculated based on a person’s financial history, such as loan repayments, credit card usage, and overall debt management.

Credit scores are used by banks, lenders, landlords, and even some employers to assess how financially reliable someone is. Whether applying for a loan, renting a property, or getting a credit card, credit score checks play a critical role in decision-making.

Why Credit Score Checks Matter Today

In today’s digital and financially interconnected world, credit scores influence various aspects of everyday life. Here’s why credit score checks are more relevant than ever:

-

Loan Approvals: Banks and financial institutions use credit scores to approve or reject loan applications.

-

Interest Rates: Better credit scores often lead to lower interest rates, saving individuals money.

-

Rental Housing: Landlords may check credit scores to evaluate a tenant’s ability to pay rent on time.

-

Job Applications: In some sectors like finance, employers may consider a candidate’s credit report during background checks.

-

Utility and Mobile Services: Telecom companies may check credit scores before issuing postpaid plans.

Who it affects:

-

Individuals applying for loans, mortgages, or credit cards

-

Students seeking education loans

-

Entrepreneurs needing business financing

-

Tenants and job applicants

Problems it helps solve:

-

Minimizes financial risk for lenders

-

Encourages responsible borrowing behavior

-

Promotes transparency in financial transactions

Recent Updates and Trends (2024–2025)

The landscape around credit score checks is evolving. Here are a few notable updates from the past year:

| Date | Update |

|---|---|

| Jan 2024 | Experian and Equifax introduced new AI-driven credit scoring models. |

| May 2024 | RBI (India) issued guidelines to improve transparency in credit reports. |

| Oct 2024 | FICO 10T became more widely adopted in the U.S., focusing on trending data. |

| Mar 2025 | Growing adoption of open banking is influencing credit scoring mechanisms. |

-

Real-time credit monitoring apps gaining popularity.

-

Alternative credit scoring using utility and rent payment data.

-

Increased consumer access to free credit reports via digital platforms.

These changes aim to make the credit system more inclusive, especially for people with limited credit history.

Regulations and Legal Framework

Credit score checks are regulated by financial authorities to protect consumer rights and ensure transparency.

India

-

Regulated by: Reserve Bank of India (RBI)

-

Credit Bureaus: CIBIL, Experian, Equifax, CRIF High Mark

-

Right to Access: Every Indian citizen can access one free credit report per year from each bureau.

-

RBI Guidelines: Institutions must inform customers when a credit check is performed.

United States

-

Regulated by: Fair Credit Reporting Act (FCRA)

-

Key Provisions:

-

Consumers can request a free report annually from each of the three main bureaus.

-

Employers need written consent for a credit check.

-

Consumers have the right to dispute inaccurate information.

-

United Kingdom

-

Regulated by: Financial Conduct Authority (FCA)

-

Rules: Credit Reference Agencies (CRAs) like Experian and TransUnion must provide clear reports.

-

Consumers can check reports for free using services like ClearScore or Experian.

Tools and Resources for Checking Credit Scores

There are several online platforms and apps that help individuals monitor and improve their credit scores. These tools are often free or low-cost and offer detailed insights.

| Tool/App | Features |

|---|---|

| CIBIL (India) | One free report per year, credit simulator, score tracker |

| Credit Karma (US) | Free reports, credit monitoring, personalized recommendations |

| ClearScore (UK) | Monthly updates, budgeting tools, financial health insights |

| Experian | Reports, credit lock features, identity theft protection |

| WalletHub | Real-time updates, credit improvement tips, secure and easy to use |

| Paytm (India) | Free credit score check, EMI tracking, personalized finance tips |

-

AnnualCreditReport.com (US) – Official site for free annual credit reports

-

RBI’s official site – Regulatory guidelines on credit reports in India

-

FCA website (UK) – Consumer rights and how to dispute errors

Frequently Asked Questions (FAQs)

1. How often should I check my credit score?

It's advisable to check your credit score at least once every 3–6 months. Regular monitoring helps detect inaccuracies and avoid surprises during loan applications.

2. Does checking my own credit score lower it?

No. When you check your credit score (a soft inquiry), it doesn’t affect your score. Only hard inquiries made by lenders can have a temporary impact.

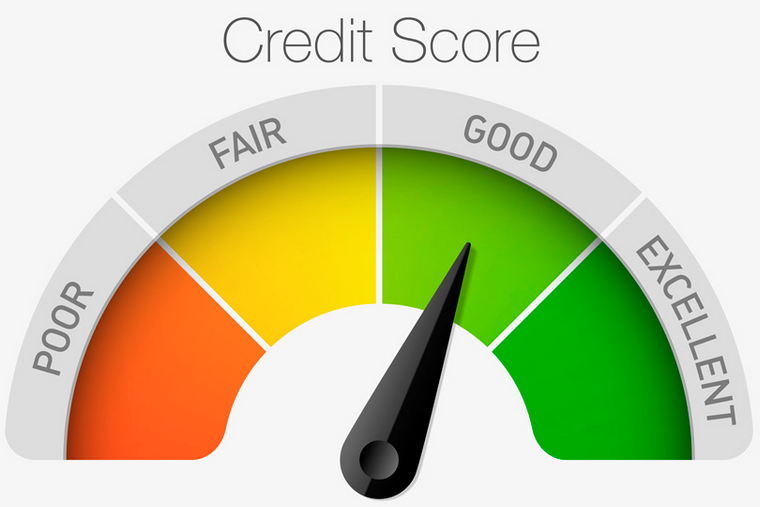

3. What is considered a good credit score?

Here’s a general guideline:

| Score Range | Rating |

|---|---|

| 750 – 900 | Excellent |

| 700 – 749 | Good |

| 650 – 699 | Fair |

| 600 – 649 | Poor |

| Below 600 | Very Poor |

4. How can I improve my credit score?

-

Pay credit card bills and EMIs on time

-

Maintain a low credit utilization ratio

-

Avoid multiple loan applications within short periods

-

Check your report regularly and dispute errors if any

-

Keep old credit cards active (length of credit history matters)

5. Can I check my credit score for free?

Yes. Most countries have legal provisions allowing consumers at least one free report per year from each credit bureau. Many private apps also offer free checks without affecting your score.

Conclusion

Understanding and checking your credit score is crucial for personal financial health. It empowers individuals to make informed decisions, unlock better financial opportunities, and stay in control of their credit history. With the rise of accessible tools, transparent regulations, and AI-powered assessments, credit score checks are becoming a normal and essential part of managing your money.